See flyer for details. If you have any questions, call (904) 491-7300.

-Sabrina Robertson

Public Information Officer

Welcome to beautiful Nassau County, located in the northeast corner of Florida along the Atlantic Ocean and Interstate 95. We are proud to serve as the Eastern Gateway to the Sunshine State. From our historic island, sandy beaches, and championship golf courses to our scenic rivers, green pastures, and majestic timberlands, we truly offer something for everyone.

The Nassau County Property Appraiser is offering Saturday hours this month to provide additional opportunities for residents to come in, ask questions about property values, and file for homestead exemption. See flyer for details. If you have any questions, call (904) 491-7300. -Sabrina Robertson Public Information Officer

0 Comments

5/3/22 @ 1:30 p.m. - The Nassau County Property Appraiser has announced that his office is now accepting exemption applications for the 2023 tax year. If you purchased property that is your permanent residence in calendar year 2022, you may file online for the 2023 Homestead Exemption reduction through March 1, 2023. This exemption will be reflected on your Notice of Proposed Property Taxes to be sent out in mid-August 2023. Please click here to be directed to the Property Appraiser's Website for additional information, as well as a link to apply online. If you have any questions, please call the Property Appraiser's Office at (904) 491-7300. -Sabrina Robertson Public Information Officer 8/23/21 @ 4:00 p.m. - Nassau County Property Appraiser, A. Michael Hickox, made the below post on the department's FaceBook page providing valuable information related to the Truth in Millage (TRIM) notices that was mailed to property owners on August 19th. If you have any questions, his office can be reached at (904) 491-7300. From A. Michael Hickox, Nassau County Property Appraiser:

The Notice of Proposed Property Taxes (TRIM Notice) informs the owner of their proposed property values, exemptions, and millage rates for their upcoming tax bill. It states the fair market, assessed, and taxable values. The assessment reductions and exemptions are also listed. The TRIM Notice includes information on proposed millage rates set by the taxing authorities. In addition, it includes times and locations for public hearings being held by these taxing authorities to discuss their tentative budgets, from which their millage rates are set. These meetings are very important, as the millage rates approved by these entities will affect the amount of taxes you pay. TRIM Notices were mailed out on August 19th. Once received, please promptly examine it to verify that all pertinent information is correct. If you believe information to be in error or if you have any question, we invite you to call and discuss the issue or come in and talk to an appraiser. This process will help us promptly address any concerns you may have. You can contact us at 904-491-7300. You can access a copy of your TRIM Notice from our website. http://www.nassauflpa.com/ o Use the “Property Search” feature to search for your property then select “GO” o The populated information will include a link to the TRIM Notice for the selected property. You can also access a copy of the TRIM Notice on the “Property Details” page by clicking the icon marked in the image below. 8/31/20 @ 10:45 a.m. - The Nassau County Property Appraiser is hosting informational events to allow residents to ask questions about their Truth in Millage (TRIM) statements reflecting proposed taxes for 2020.

Saturday, September 5th and Saturday, September 12th, 9am-1pm TWO LOCATIONS:

If you have any questions, please contact the Property Appraiser's Office at (904) 491-7300. -Sabrina Robertson County Manager's Office 1/3/19 @ 1:30 p.m. -Sharing this information that the Property Appraiser's Office posted on their FaceBook Page today:

***ATTENTION HOMEOWNERS*** Do you still need to file for Homestead? Are you having trouble making it to our office during normal business hours? Have no fear! The Property Appraiser’s office will have a booth at the Callahan Farmer’s Market this Saturday, January 4th, from 10am to 2pm, weather permitting. Ashley and Leslie will be there to assist you with any questions you may have about your property and/or exemptions. In addition to answering your questions, they will also be taking homestead applications on site!! If you plan to file for your Homestead Exemption Saturday, please click the link below for a list of the documents you and your spouse (if married) will need to provide. https://www.nassauflpa.com/exemptions-…/homestead-exemption/ Hope to see you there! Callahan Farmer’s Market 45383 Dixie Ave Callahan, FL 32011 If you have any questions, please contact the Property Appraiser's Office at (904) 491-7300. -Sabrina Robertson County Manager's Office 9/2/19 @ 9:20 a.m. - The Property Appraiser's Office has added an additional server to address the issues they were having yesterday. The increased traffic to the site was causing it to run very slows. We are still here to answer questions and help anyone who is having trouble determining their evacuation zone.

https://maps.nassauflpa.com/NassauTaxMap/?LayerID=144&visLayers=396,9,10,11,13,144,182&FeatureID=&X1=-81.78954830169533&Y1=30.60166181725337&Level=11 -Sabrina Robertson County Manager's Office FOR IMMEDIATE RELEASE

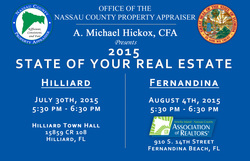

Contact: Sabrina Robertson Administrative Manager, County Manager’s Office (904) 530-6010 [email protected]. Understanding Your Proposed Tax Bill Nassau County, Florida, August 28, 2019 – Last week, all Nassau County Property owners should have received their TRIM (Truth in Millage) Statements which is a notice of proposed property taxes for the 2019 tax bills to be mailed in November. We felt it would beneficial to provide an explanation to ensure every property owner has an understanding of which taxing authorities are proposing changes to the millage rate, as well as other variables that could affect the amount of taxes to be paid in 2019. Below is an example of a TRIM notice for property located in the City of Fernandina Beach. In this example, the first taxing authority is the Nassau County Board of County Commissioners. If you look at column 1, you will see that Nassau County’s millage rate in 2018 was 7.4278. You will also notice in column 3 that the proposed tax rate for 2019 is also 7.4278. This indicates that the Board of County Commissioners are NOT proposing a tax increase this year. The information reflected in Column 2 is the “Rolled Back” rate. This is the rate the Board would need to levy to generate the same amount of revenue we generated in 2018. While the Board could agree to “roll back” the millage rate, doing so could eliminate items included in the proposed 19/20 Budget including 15 new Sheriff positions, 10 new fire rescue positions, a new brush truck and tanker truck, 5 new positions for the Road Department dedicated to improving drainage across the County, among many other things. The roll back would reduce the 2019-2020 proposed budget by approximately $7 million. The example shown also reflects taxes assessed by the City of Fernandina Beach since this property is located within the City limits. TRIM notices for property owners within the Towns of Callahan or Hilliard will reflect taxes assessed by those municipalities as well. Other taxing Districts that assess taxes to all Nassau County properties include: The School Board, St Johns River Water Management District, and Florida Inland Navigation District. The columns show all taxing authorities’ 2018 adopted rates, as well as their 2019 proposed millage rates. Should you have questions about any of the taxes being assessed, you should contact each individual taxing authority to ask questions, prior to their public hearing dates which are shown on the far right of your TRIM notice. You may also notice in the example above that the property tax assessed by the Board of County Commissioners in 2018 was $1,457.10, but that the property tax to be assessed by the Board of County Commissioners in 2019 is $1,491.84. Since the proposed millage rate is not changing, the reason for the increase to the amount being paid to Nassau County is solely due to an increase in the property’s assessed value and not by a raise in the millage rate. Property values rise for various reasons and are controlled by State Statutes and Resolutions. Items that affect property values include home improvements, neighborhood improvements, construction of new homes nearby, and increases to the value of your land. Should you have questions about how your property was assessed you should contact the Property Appraiser’s Office at (904) 491-7300, before the deadline reflected on your TRIM Notice. Should you still feel the market value of your property has been assessed too high, you can also file a petition to the Value Adjustment Board by contacting the Clerk of Courts at (904) 548-4600.  According to a Press Release issued by the Property Appraiser's Office, Nassau County Property Appraiser, Mike Hickox, will host two Town Hall Meetings to discuss 2015 property values and the valuation process. He will also answer any questions concerning property assessments and exemptions in an attempt to help property owners better understand their assessments prior to receiving their notice of proposed taxes for 2015. New 2015 preliminary values are now posted on their website at www.nassauflpa.com. Town Hall Meeting: Thursday, July 30, 2015 from 5:30-6:30 p.m. Hilliard Town Hall Building 15859 County Road 108 Hilliard, FL 32046 Fernandina Town Hall Meeting Tuesday, August 4, 2015 from 5:30 - 6:30 p.m. Amelia Island - Nassau County Association of Realtors 910 South 14th Street Fernandina Beach, FL 32034 For more information regarding the Town Hall Meetings, please contact Justin Taylor at (904) 491-7304 or via e-mail at [email protected]. -Sabrina Robertson County Manager's Office |

Archives

June 2024

Categories

All

|