Contact:

Sabrina Robertson

Administrative Manager, County Manager’s Office

(904) 530-6010

[email protected].

Understanding Your Proposed Tax Bill

Nassau County, Florida, August 28, 2019 – Last week, all Nassau County Property owners should have received their TRIM (Truth in Millage) Statements which is a notice of proposed property taxes for the 2019 tax bills to be mailed in November. We felt it would beneficial to provide an explanation to ensure every property owner has an understanding of which taxing authorities are proposing changes to the millage rate, as well as other variables that could affect the amount of taxes to be paid in 2019.

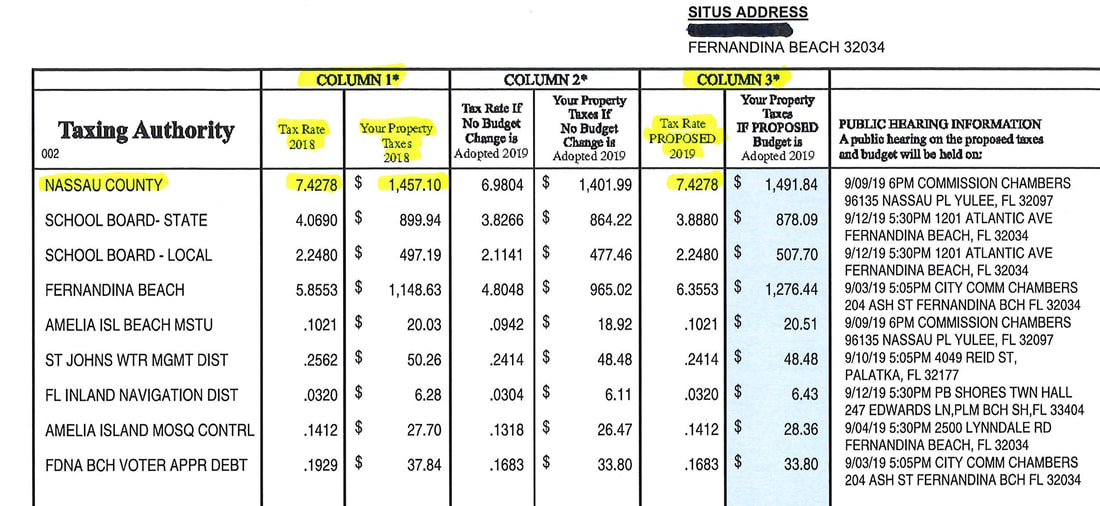

Below is an example of a TRIM notice for property located in the City of Fernandina Beach. In this example, the first taxing authority is the Nassau County Board of County Commissioners. If you look at column 1, you will see that Nassau County’s millage rate in 2018 was 7.4278. You will also notice in column 3 that the proposed tax rate for 2019 is also 7.4278. This indicates that the Board of County Commissioners are NOT proposing a tax increase this year.

The information reflected in Column 2 is the “Rolled Back” rate. This is the rate the Board would need to levy to generate the same amount of revenue we generated in 2018. While the Board could agree to “roll back” the millage rate, doing so could eliminate items included in the proposed 19/20 Budget including 15 new Sheriff positions, 10 new fire rescue positions, a new brush truck and tanker truck, 5 new positions for the Road Department dedicated to improving drainage across the County, among many other things. The roll back would reduce the 2019-2020 proposed budget by approximately $7 million.

The example shown also reflects taxes assessed by the City of Fernandina Beach since this property is located within the City limits. TRIM notices for property owners within the Towns of Callahan or Hilliard will reflect taxes assessed by those municipalities as well. Other taxing Districts that assess taxes to all Nassau County properties include: The School Board, St Johns River Water Management District, and Florida Inland Navigation District. The columns show all taxing authorities’ 2018 adopted rates, as well as their 2019 proposed millage rates. Should you have questions about any of the taxes being assessed, you should contact each individual taxing authority to ask questions, prior to their public hearing dates which are shown on the far right of your TRIM notice.

You may also notice in the example above that the property tax assessed by the Board of County Commissioners in 2018 was $1,457.10, but that the property tax to be assessed by the Board of County Commissioners in 2019 is $1,491.84. Since the proposed millage rate is not changing, the reason for the increase to the amount being paid to Nassau County is solely due to an increase in the property’s assessed value and not by a raise in the millage rate.

Property values rise for various reasons and are controlled by State Statutes and Resolutions. Items that affect property values include home improvements, neighborhood improvements, construction of new homes nearby, and increases to the value of your land. Should you have questions about how your property was assessed you should contact the Property Appraiser’s Office at (904) 491-7300, before the deadline reflected on your TRIM Notice. Should you still feel the market value of your property has been assessed too high, you can also file a petition to the Value Adjustment Board by contacting the Clerk of Courts at (904) 548-4600.

RSS Feed

RSS Feed