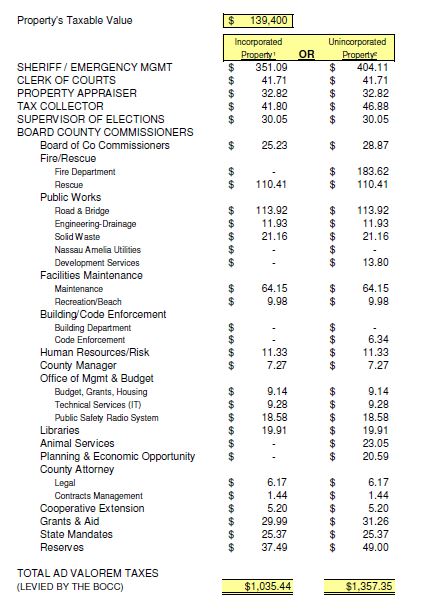

The Board of County Commissioners want you to know how your tax dollars are being spent. Did you know that we have a tool on our website that will tell you, down to the penny, how your tax dollars are being allocated? To the left is a example of this document that provides a complete breakdown of how taxes for property with the average taxable value of $139,400 is distributed.

Depending on the location of the property, the Board of County Commissioners would assess $1,357.35 if you reside in the unincorporated (County) area or $1,035.44 if located with a municipality (city/town). These fees do not include property taxes assessed by the School Board, City, Towns, St. Johns River Water Management District, Florida Inland Navigation District, or other taxing authorities that are reflected on your tax bill.

Now lets look at how that money is allocated. In the attached example, a property located in the unincorporated area of the County with a taxable value of $139,400, is contributing $1,357.35 to the Board of County Commissioners. Of that, you will see over half is allocated to public safety, with $404.11 to the Sheriff and $294.03 to fire/rescue. The other half is allocated to many other departments/services of the Board of County Commissioners including:

- $19.91 for operation of 5 public libraries

- $9.98 to Parks & Recreation for 4 ballparks, 7 boat ramps, 5 beach front parks and walkovers, and several playgrounds and recreational spaces

- $18.58 for monitoring and maintenance of the public safety radio system which is used for 9-1-1 dispatchers and emergency personnel to communicate

- $113.92 to Road & Bridge for general road and right-of-way maintenance and construction of new roads

- $11.93 to Engineering for services such as issuing driveway permits, sidewalk design, road design, review of development plans, and more

- $6.34 to Code Enforcement to address violations such as overgrown grass and accumulation of trash, litter, and debris on private property

- $23.05 to Animal Control to assist in pickup of stray animals, adoption programs, vaccinations, shelter supplies, etc.

These are just a few! In addition to the above services, there are many other departments shown in the example that provide administrative services to the Board of County Commissioners and residents. Also included in the $1,357.35 paid to the Board of County Commissioners are allocated tax revenues to fund operations of other constitutional offices in accordance with Florida Statute (Sheriff, Clerk of Courts, Supervisor of Elections, and Property Appraiser) and certain State mandated services such as Medicaid, Department of Juvenile Justice, and Medical Examiner.

If you are interested in learning more about how your tax dollars are being utilized, grab your 2018 TRIM notice, find your property's taxable value for 2018, and download the attached interactive form. You may be surprised to see how many services your assessment supports and how far that money is spread out.

If you have any questions, please contact our Budget Director, Justin Stankiewicz, at (904) 530-6010 or via email at [email protected].

-Sabrina Robertson

County Manager's Office

RSS Feed

RSS Feed