Impact Fees are a one-time fee collected when building permits are issued to fund future construction and improvements needed to accommodate growth.

There are currently five types of impact fees collected by the County: educational impact fees, recreation impact fees, administrative impact fees, fire impact fees, and law enforcement impact fees. The County also collects mobility fees to fund road improvements. While not an impact fee, it is still a fee charged during the permitting process to ensure that the builder bears the costs for improvements necessary to accommodate extra vehicles or “trips” to a home or business.

In August 2018, the Board hired a consultant to review recreation impact fees to ensure that adequate funds are being collected for construction of parks and recreational facilities to meet the demands created by residential development. The study is still underway and is expected to be completed in the fall of 2020.

In February 2019, the Board directed staff to move forward with ordering a study to review Fire Rescue Impact Fees, Sheriff Impact Fees and Administrative Impact Fees. This is being done to ensure amounts being collected are sufficient in comparison to counties of similar size and to ensure that any needed improvements are paid for by the individual pulling the permit rather than burdening taxpayers by using ad valorem revenues.

Sheriff Impact Fees are Fire Impact Fees are based on the knowledge that public safety needs are directly proportional to the presence of people. With growth comes the need for new fire stations, larger jails, and equipment for public safety personnel. Administrative Impact Fees are used for building, renovating, and/or expanding public buildings such as courthouses, maintenance facilities, and administrative offices. Sometimes a project will require use of multiple impact fee funds for a project. For example, the Sheriff’s Administrative Building was partially paid for with a combination of Law Enforcement and Administrative Impact Fees.

The County secured Tischler Bise, a fiscal and planning consulting firm, to perform an update/calibration of the County’s Fiscal Impact Model used to assess the fiscal impact of proposed development projects and rezonings in the County. The preliminary results were presented to the Board of County Commissioners at their meeting held on December 9, 2019.

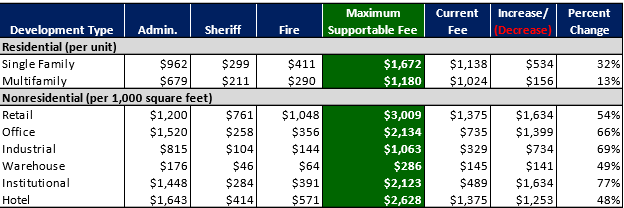

Below is a chart reflecting the total impact fees currently being collected by Nassau County, as well as the maximum supportable fee for each development type.

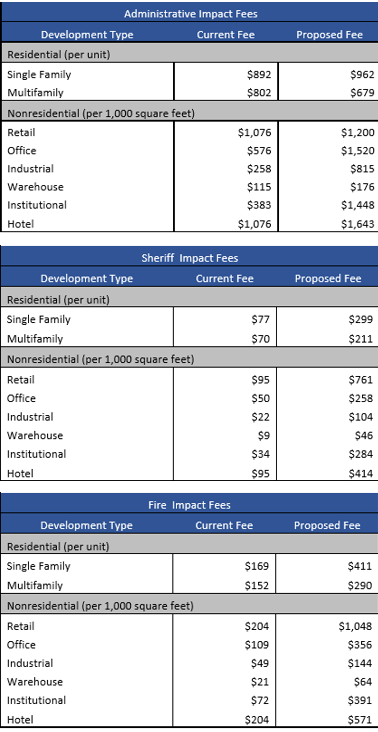

Below is a chart showing the current and proposed fees to be considered by the Board:

-Sabrina Robertson

County Manager's Office

RSS Feed

RSS Feed